FAQ

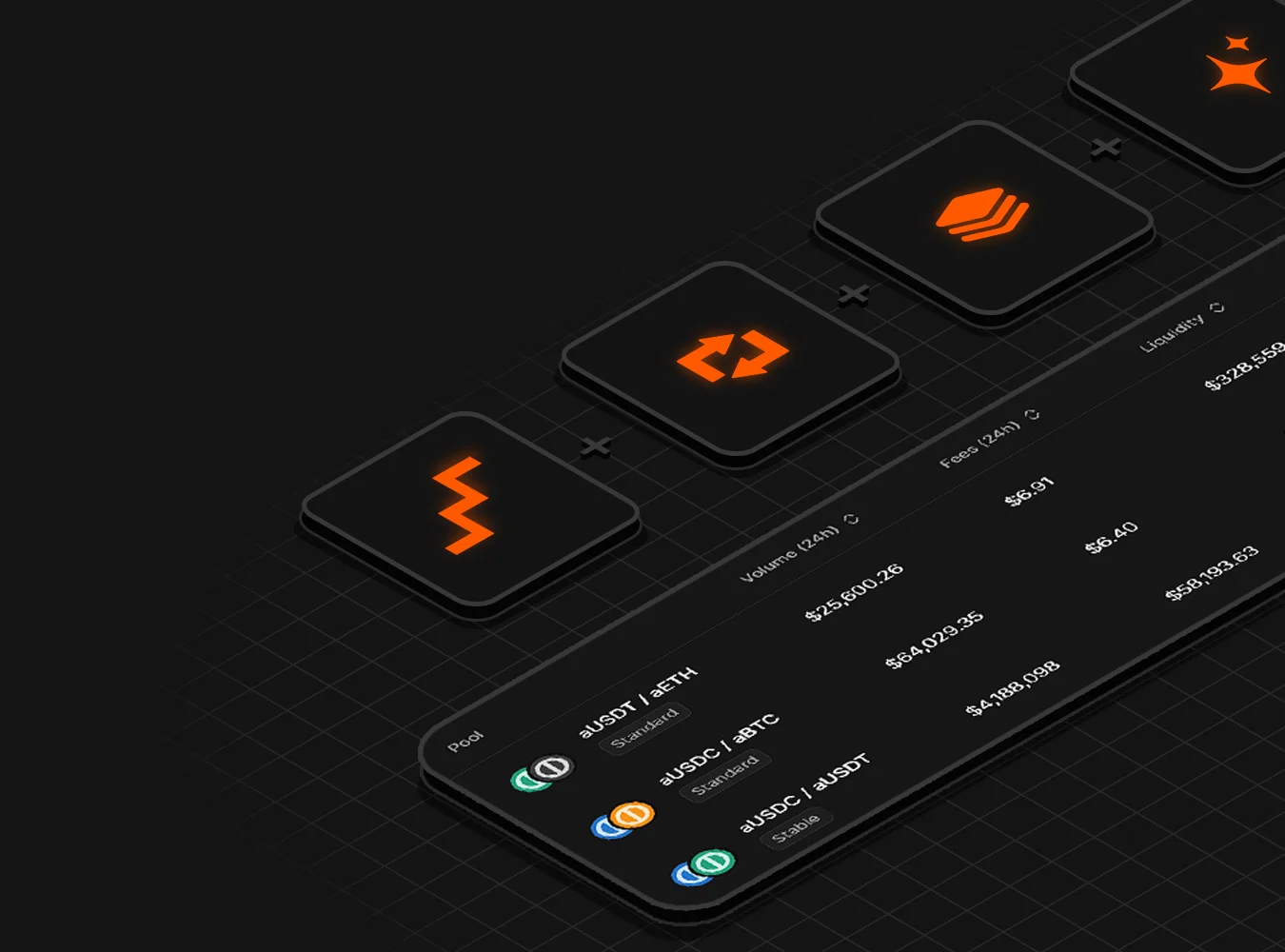

Alphix is a DeFi protocol built on Uniswap V4 that introduces Unified Pools. By stacking multiple features into a single pool, we eliminate liquidity fragmentation and create more efficient markets. Think dynamic fees, liquidity rehypothecation, and other innovations, all coexisting without splitting liquidity.

The main barrier to hook adoption is fragmentation. Every new feature typically requires its own pool, splitting liquidity and volume. Alphix solves this with Unified Pools that combine multiple features into one, enabling us to compete with larger incumbents despite their liquidity depth advantages.

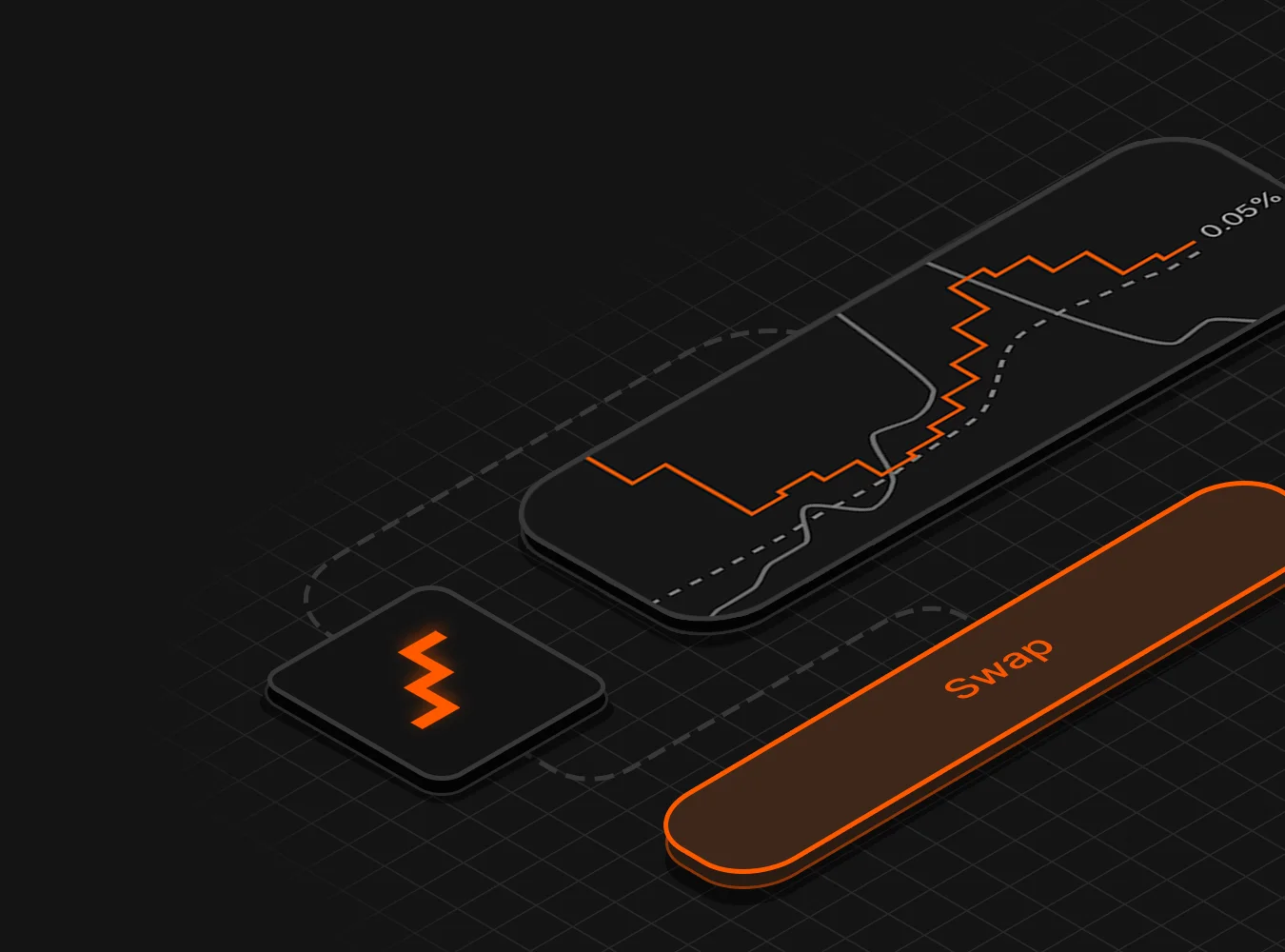

Unlike traditional AMMs locked to fixed fee tiers, our dynamic fee algorithm is fully unbounded. It adjusts fees in real-time based on each pool's Volume/TVL ratio, finding the market optimum automatically. Quiet markets see lower fees to attract volume, while busy periods increase fees to maximize LP returns.

Security is non-negotiable for us. We work with leading security teams to audit every feature before it is added to Unified Pools. Alphix is fully non-custodial, meaning you retain complete control over your assets at all times. No protocol can be considered entirely risk-free, but we take extensive steps to minimize risks.

Alphix is live on Base. We chose Base for its strong growth potential and alignment with the Uniswap ecosystem.

You can provide liquidity directly through our app by depositing tokens into Unified Pools. For trading, you can swap directly on Alphix or through aggregators like KyberSwap and 1inch once integrated.